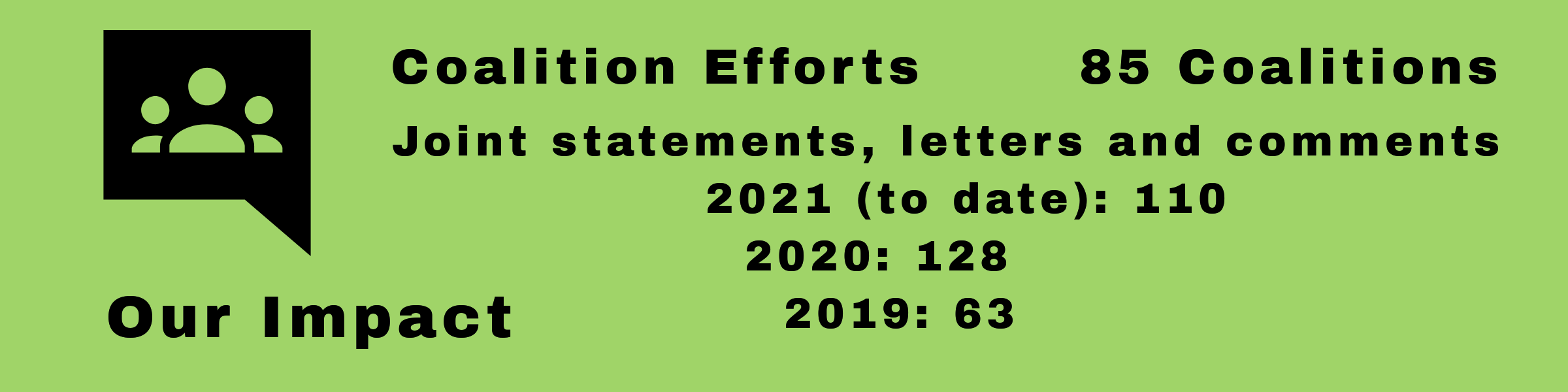

Coalition Efforts

Consumer Action is working on these important issues along with other organizations. If you would like to know more about these issues, please see “More Information” at the end of each article.

Postings

Protect the rights of 45 million contact lens consumers

In a letter to Congress, advocates urged legislators to oppose the so-called Contact Lens Prescription Verification Modernization Act (S 1784 and HR 3353). The bills aim to undo almost two decades of protections for contact lens consumers, would drive up prices, and would reduce choices for contact lens consumers.

Protect retirees and savers from conflicted investment advice

A broad coalition of leading worker, consumer and investor advocates has urged the Department of Labor (DOL) to quickly update and strengthen the rules governing retirement investment advice to help protect workers and retirees from harmful conflicts of interest. Conflicted retirement investment advice costs retirement savers tens of billions of dollars every year.

It’s time to stand up for patients and to stop Big Pharma from ripping us off

As the Senate considered the terms of a reconfigured reconciliation package, 91 organizations representing patients, consumers, seniors, unions, small businesses, large employers, and physicians and disease advocacy groups sent a letter to all 50 Senate Democrats urging them to take immediate action to advance a reconciliation package that includes the reforms to lower prescription drug prices in the Build Back Better Act (BBB). These drug pricing reforms are not controversial for the people of America; they are the most popular element of BBB. Over 80% of Americans support them—Democrats, Republicans and Independents alike.

Regulators should reject FinTech startup’s bank charter application

Advocates called upon federal banking regulators to reject a worrisome and inadequate bank charter application recently filed by Figure Bank, National Association. The coalition warns that the FinTech company’s bank application is silent about core issues of honesty, transparency and sustainability. Federal banking regulators are the public’s first line of defense. They have a duty to protect the public from investors who are more interested in lining their own pockets than in helping their customers and communities build wealth.

The CFPB must protect consumers from fraud in payment systems

Consumer Action was one of the 65 consumer, civil rights, faith, legal services and community groups that submitted comments to the Consumer Financial Protection Bureau (CFPB) in response to its inquiry into certain business practices of six large technology companies operating payments systems in the United States. The groups urged the CFPB to require person-to-person (P2P) payment providers to protect consumers from fraud and errors and to work with the Federal Reserve Board to ensure protections are in place before the Fed launches its new FedNow P2P service.

Feds should halt bank mergers until guidelines are strengthened

The federal authorities should halt all bank merger approvals until they strengthen the outdated guidelines that govern whether financial institutions can combine, according to a letter delivered by 30 public interest organizations. Advocates outlined the harmful effects—including more evictions, increasing rates of debts in collection, and fewer loans supporting economic development—that bank consolidation has had on consumers and small businesses, especially in communities of color.

As the pandemic continues, the Build Back Better Act aims to provide critical assistance to American families

Consumer Action joined over 200 national, state and community organizations in thanking the House of Representatives for the momentous gains made in the Build Back Better Act, reinforcing the need to keep the package intact as it makes its way through the Senate, and urging swift passage onto signature by President Biden. By passing the historic Build Back Better bill, Congress is tackling some of the most important problems families face, by accomplishing things such as cutting taxes for working and middle class families, supporting child and elder care, making college more affordable, providing job training, and making the largest investment in battling climate change in our nation’s history.

Americans need drug pricing reform now

Consumer Action joined more than 60 national, state and local groups in urging Senate Majority Leader Chuck Schumer and Speaker of the House Nancy Pelosi to resist demands from some caucus members seeking to weaken the Medicare drug price negotiation policies in the Build Back Better Act. The bill aims to lower drug prices for millions of Americans by allowing Medicare to negotiate certain drug prices, penalizing drug companies that increase their prices faster than inflation, and adding an out-of-pocket cap to Medicare Part D. Advocates warn that weakening this popular policy would allow Big Pharma to continue to gouge Americans and profit from exorbitantly high drug prices.

Congress to protect all Medicare beneficiaries in reconciliation bill

Consumer Action joined 45 leading consumer, disability, minority health and provider organizations in thanking Congress for taking steps to protect Medicare Advantage beneficiaries when adding new benefits to fee-for-service (FFS) Medicare and encouraging lawmakers to maintain this language in the final bill. The letter comes as Congress considers adding vision, hearing and dental benefits to FFS Medicare as part of its emerging reconciliation package.

A call for President Biden to end Big Pharma monopolies

Coalition members wrote to U.S. Health and Human Services (HHS) Secretary Xavier Becerra demanding that the White House take on Big Pharma in an effort to curb drugmakers’ monopoly power in the soon-to-be-released HHS drug pricing competition plan. Advocates called on President Biden to end the era of abusive drug pricing and treatment rationing by challenging patents and expanding generic-drug competition. As Americans face a new surge in the ongoing pandemic, there is no better time than now to break up Big Pharma monopolies.

Quick Menu

Support Consumer Action

Join Our Email List

Insurance Menu

Help Desk

- Help Desk

- Submit Your Complaints

- Frequently Asked Questions

- Links to Consumer Resources

- Consumer Services Guide (CSG)

- Alerts